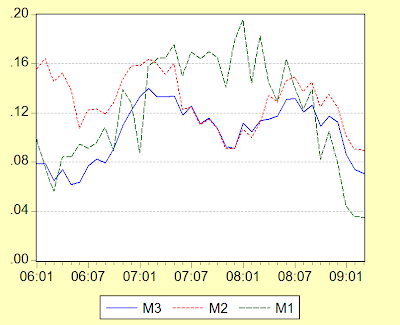

…and net of inflation:

Note that net M1 growth is essentially zero, while M3 growth is at just 3.6%. If you saw my post on Malaysia’s leading indicators, the forecast for GDP growth looks like it’ll hit negative 1% for 1Q 2009, which implies that money supply growth is still supportive of economic activity. This assessment ignores the possibility of the velocity of money (the rate at which money flows through the economy) falling however.

Back in March, I talked about the instability of money velocity and how it impacts monetary policy evaluation. Recall that the relationship between money and economic growth can be shown through the Fisher Identity:

Ln(ΔM) + Ln(ΔV) - Ln(ΔP) = Ln(ΔY)

Substituting the known numbers (including forecast rGDP) yields an expected velocity of -4.3%. My estimate of actual change in velocity in 1Q is about 2.0%, which means growth in M3 is higher than strictly required – thus we’re still looking at a loose monetary policy stance. This is with the proviso that both inflation and velocity are showing base effects – the levels for both have been dropping since the peak of the commodities boom in the middle of last year:

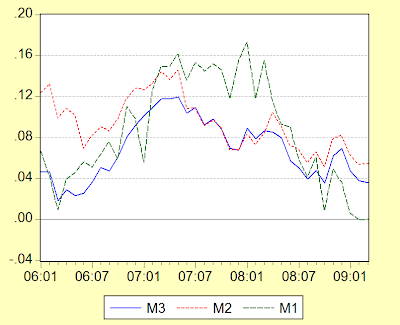

As a side note, I stumbled on this chart while preparing this post (monthly log changes in money velocity):

Money velocity has been considerably more volatile since abolishing the USD peg – in fact so have spreads and volatility of market interest rates. I’m speculating this has to do with portfolio flows, but certainly something for future investigation.

As I mentioned in the previous post, the monetary policy stance is unambiguously loose, but not to the degree I would like to see it. One way to support or disprove my opinion (and it is just an opinion), is to evaluate monetary policy based on some form of Taylor Rule which provides a consistent approach to interest rate policy setting. Does BNM follow a Taylor Rule? Given the shift to the OPR as the policy instrument, this is more than a possibility – again an area for future investigation.

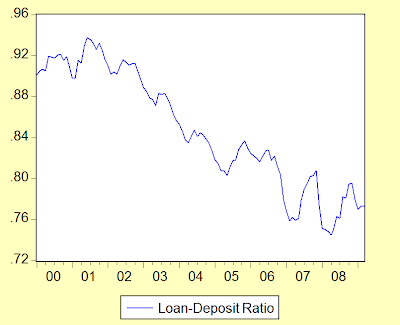

Despite my misgivings regarding the cost of credit, bank lending growth is actually fairly solid (annual log changes in total loans):

…and based on plenty of resources:

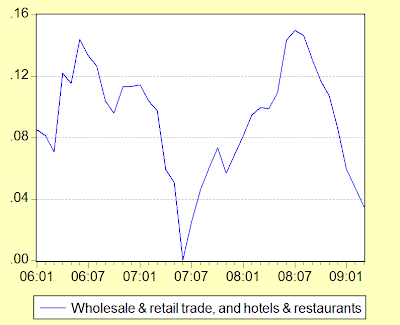

Unfortunately, direction of lending is a bit of a mixed bag (log annual changes):

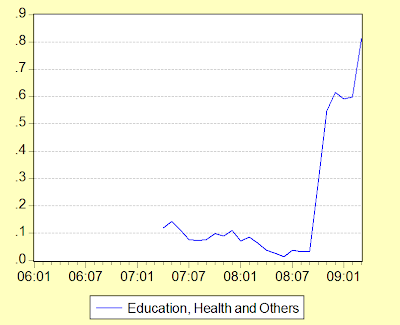

Loan growth to the financial sector at nearly 20% per annum doesn’t strike me as a terribly healthy development. I like this one though:

That’s right – 81.2% annual growth in March 2009. The runup appears to have started in October – no guesses as to why.

No comments:

Post a Comment