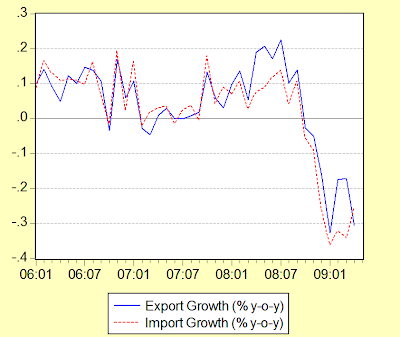

But actual volume has leveled off for exports and improved in the case of imports (seasonally adjusted):

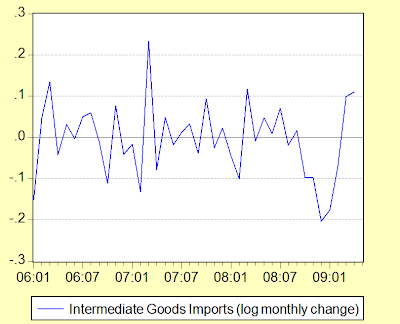

Especially encouraging is the month on month growth in intermediate goods imports, which would help determine future exports (log monthly changes):

To underscore this point, my forecast models are both pointing up (I'm abandoning the probability based ARMA model for now):

The seasonal adjustment model is still under-forecasting actual performance to the tune of RM5.6b, but the seasonal effect model remains close at under RM2.9b. May exports forecasts for my two remaining models are:

Seasonally Adjusted:

Point forecast:RM42237, Range forecast:RM47442-RM37032

Seasonal Effect:

Point forecast:RM43255, Range forecast:RM48547-RM37963

We're still going to see sharp declines in terms of growth rates, but month on month data should continue to see some improvement. While the empirical evidence is till shaky, I wouldn't hesitate to call a bottom to the downturn for now.

The big problem of course is that stability does not equate to recovery, much less a return to our previous growth path. The 1997-98 crisis caused many of the effected economies (including Malaysia's) to move to permanently lower growth paths, rather than a return to the previous one. While the external genesis of this downturn suggests the latter is at least a possibility, there are too many uncertainties to make that kind of determination yet.

Technical Notes:

Trade data from Matrade. Details on the construction of my export forecast models are available here.

No comments:

Post a Comment