The ostensible idea was to encourage "prudent spending", by effectively increasing the costs of access, which had dropped due to the proliferation of "free for life" cards. I'm not sure this is the right policy, or to be more precise, the most effective policy to implement based on the stated goal. On the other hand, a more effective policy might involve heavy handed intervention in the workings of the financial sector that would contravene the spirit of the past ten years of financial liberalization. It’s certainly generated a lot of angst among card-holders, but judging from the public response, the tax appears to be effective in achieving the government’s goal of reducing card “collections”.

But before going into a discussion of right or wrong, it's probably best to proceed from a basis of firm facts - what is the current situation in Malaysia now?

With the explosion of consumer banking that began after the 1997-98 crisis, credit cards and mortgages have been a key battleground for the banking industry. The number of cards have grown exponentially (in millions):

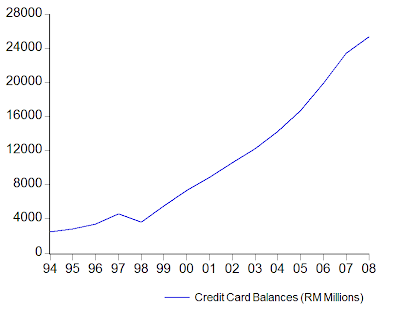

...as have outstanding balances:

This has been coupled with a fairly steady drop in bad debts, although you should note that the default rate is far from typical of other bank business lines (which average under 2%):

On the face of it, this look likes a fairly attractive market for the banks. From the consumer point of view, it doesn't look too bad either. On per card basis, it looks like consumers are acting relatively responsibly:

Balances per card are dropping, as are transactions. The percentage of balances not paid-off at the end of the reporting period is dropping as well even as credit limits are rising, indicating we're in no danger of turning into another Korea just yet.

What complicates matters is that number of cards ≠ number of cardholders. How would recasting the numbers on the basis of population look like? More specifically, based on labour force numbers, we see a very different picture - the ratio of the number of cards to the work force has risen from about 1 in 5 in 1998 to near parity in 2008:

Rollover balances have tripled in the last ten years, indicating card debt is increasing as a percentage of income, and transactions velocity has increased from about once a month to twice a month. The latter is not necessarily bad if balances were stable, but they are in fact increasing which is a little worrying.

So there’s a solid basis for the government’s concerns over easy access to high-cost personal credit. Is a flat tax the optimum effective solution to reduce card usage? Not hardly – ideally there would be some (fairly high) minimum threshold of income to qualify, and perhaps a graduated tax based on credit limits similar to the annual commitment fees banks charge businesses for revolving credit.

I’d also consider putting in a minimum interest rate floor, not just an interest rate ceiling as currently practiced. We are after all talking about unsecured revolving credit where even with bad debts at an historical low is seeing defaults average in the mid-teens (comparable to junk-bond default levels). Some banks are offering under 10% p.a. interest rate charges - I'm not sure if this is not mispricing the financial risk involved.

But such measures are a little harder to enforce on individuals – if income is the barometer, what about the self-employed or those who earn on a commission basis? If access to this segment is curtailed for what is arguably a legitimate portion of the working public, then hard rules based on income are inequitable – and we have enough inequity in this country already, thank you. It’s also more than possible to set limits on the number of cards any one person can have (through CCRIS), though this may involve some loss of privacy. On second thoughts, maybe not such a good idea.

On that basis, a flat tax is a second best solution that despite the fact that it is not yet in place, already appears to be working by all accounts - people are already talking about cutting up their excess, unused cards. I feel the tax measure was really put in place to replace the annual fees typically charged for credit cards, but too often waived by banks in the interests of gaining and retaining customers. Maybe if banks had committed to charging annual fees we might not be having this very public debate.

Technical Notes:

1. Credit card data from BNM's Monthly Statistical Bulletin.

2. Population data from DOS and EPU

bro hishamh

ReplyDeleteIs there a single Consolidated Customer Limit that can be tied to each individual card holders?

- here i'm assuming CCRIS tracks all exposure to individual IC number and if BNM sets a max limit one can get as a multiple of income level or "soft collateral" pledge like Fixed Deposit...

another thing that fuelled this growth was the policy to reduce minimum requirement...if i'm not mistaken...then the intention was to stimulate demand..

and Banks should disclose APR instead of showing the current per annum rate baru depa tau how much it cost...

tks for ur comments earlier..will revert soon, cant access intense debate inside office hours

You are thinking of something along the lines of the old CTOS system for chequing accounts?

ReplyDeleteIf my memory isn't faulty, yes it is possible within CCRIS to get a full consol view. The problem is that for limits to be effective, you have to either let BNM administer it (they don't have the manpower or expertise, and it's not really their business), or let the individual banks have a look - hence why I said loss of privacy. There are competitive concerns involved here as well.

IIRC, banks are only supposed to access total consolidated outstanding, which doesn't include credit limits.

Doubtful even then if that info ever gets down to sales agents.