As I thought it might, October exports blew past consensus estimates, but was right in line with where I felt it would be, at the upper end of the forecast range:

Seasonally adjusted model

Seasonal difference model

Growth was pretty spectacular, with a return to postive growth on an annual basis (log annual difference):

...and hefty gains in a month on month comparison (log monthly difference):

There's two scenarios we could be looking at here - first is that this is just a bounce to compensate for the reduction in output during fasting month and Hari Raya, in which case November numbers might disappoint. Second, and I think this is more likely, we are seeing a true recovery in levels which might be sustained:

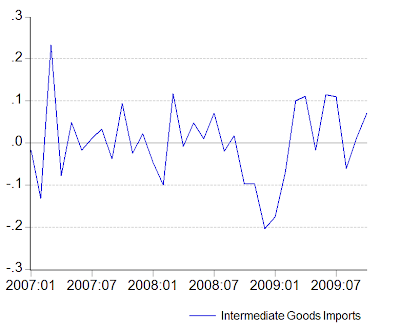

1. The first scenario implies a running down of inventories, which isn't corroborated by sustained imports of intermediate goods in October (log monthly changes):

2. Capital goods imports have also spiked, suggesting expansion in capacity (log monthly changes):

3. With the holiday season around the corner, we would expect exports of electricals and electronic products to remain sustained for the November-December timeframe.

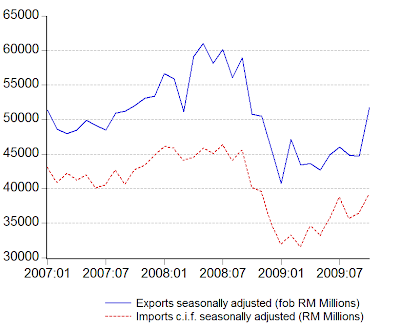

That doesn't mean we're going to see the same pace of growth in November however. E&E exports (for that matter exports as a whole) have largely regained ground lost during the downturn, and are now back to 2007 levels (RM Millions):

Prospects for further trade growth hinge greatly on a sustained recovery in Malaysia's major trade partners. Our regional partners appear to be doing well, but the West is another matter entirely.

As per last month's post, I fully expect the November forecasts to underperform actual realization, so take the upper bound as having a greater likelihood of ocurring.

Seasonally adjusted model

Point forecast:RM47,401m, Range forecast:RM53,288m-RM41,513m

Seasonal difference model

Point forecast:RM49,652m, Range forecast:RM56,605m-RM42,700m

Technical Notes:

Trade data from MATRADE

No comments:

Post a Comment