I thought I might take a little time to clarify a few things from my previous post.

First, why does the exchange rate regime matter in terms of movements in reserves? In theory, a fixed exchange rate regime requires that a central bank buys and sells foreign currency to maintain the exchange rate parity between the domestic currency and the target currency, which is typically either the USD (a'la Bretton Woods arrangements from 1944-1972) or a "basket" of currencies. Both China (implict) and Hong Kong (very explicit) use fixed rate regimes. Singapore is slightly different - MAS uses an exchange rate target to manage domestic monetary conditions, although the mechanism is similar.

With a fixed rate target, reserves will accumulate or be lost with changes in trade and capital flows - if there is an excess of inflows (trade surplus, or portfolio inflows), then demand for local currency exceeds foreign currency and the exchange rate should appreciate.

To maintain parity, the central bank creates domestic money (yes, out of thin air - it's only an accounting entry), and uses this to buy foreign currency. This has the effect of meeting the increased demand for local currency, as well as simultaneously creating greater demand for foreign currency, and hopefully balancing out the market exchange rate. In this scenario, the foreign currency bought by the central bank goes into its foreign exchange reserves account (on the asset side of the central bank's balance sheet), while liabilities (domestic cash) increases by the same portion.

A secondary effect of these transactions is thus a de facto increase in the domestic money supply and downward pressure on interest rates, since money was created to buy the foreign currency. If this is a concern to the central bank, then it "sterilises" the intervention by draining liquidity from the money market through the issue of securities. The total net effect of a full intervention and sterilisation exercise is thus an increase in reserves (assets) and an increase in issued securities (on the liabilities side), with the money supply staying pat.

The reverse happens when there is an outflow and full intervention - reduction in reserves (asset side) and a reduction in money supply (liabilities) in the case of non-sterilisation, or reduction in securities (liabilities) in the case of sterilisation.

There's actually only one effective difference between money and securities - they're both liabilities of the central bank, but from the banking system's perspective only money can be used to further credit (i.e. loans to you and me). Hence, in a fixed rate regime, domestic monetary policy operations are far more complicated.

Under a free float regime, of course, there's no apparent necessity for intervention at all and thus no incentive to accumulate reserves, except for one big reason I'll cover later.

So given the narrative above, here's what happened in Malaysia in 2008:

1. Big changes in inflows and outflows

First the run-up in commodity prices increased Malaysia's exports earnings beyond the average, up to about the middle of 2008 (trade balance, balance of payments basis, RM millions):

Then, as the financial crisis took hold in the latter half of 2008, there was a huge flight to safety by foreign investors:

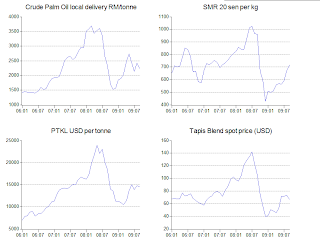

2. And here's what the commodity and financial markets were doing:

Notice the symmetry between all the markets. Also note that investors (the smart money) had already begun to pull out before the markets peaked.

3. The impact on financial institutions:

Here's one good reason why a central bank would accumulate reserves even under a floating regime - if foreign liabilities exceeds assets, then there is the potential for an external default in either the private sector or within the banking system itself - not from insolvency, but through lack of liquidity. You have the money, but not the right kind of money. To avoid that, you save up on the right kinds of external money to make sure you can meet all your external obligations i.e. accumulate reserves.

Another way of having this insurance is by doing swap agreements with other central banks, thus creating a collective pool of external reserves i.e. what we're doing now under the Chiang Mai Initiative. This reduces the cost of hoarding on your own.

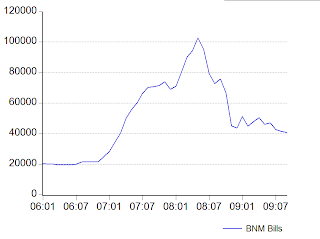

4. And this what BNM did to manage the whole shebang (all items from BNM's balance sheet, RM millions):

Note how this fits into the narrative above. With upward pressure on the Ringgit in 2007-2008, BNM intervened by supplying Ringgit to the market in exchange for foreign currency, while simultaneously issuing BNM bills to limit growth in the domestic money supply. After commodity prices started dropping, and portfolio investors started pulling out, the opposite happened - intervention to support the Ringgit, and buying and cancelling of bills to ensure the domestic money market remain liquid.

While BNM does not have an exchange rate target (at least I don't think they do), from comments by the Governor they have made a commitment to reduce volatility - in other words, they won't stop a depreciation or appreciation but they will limit excessive movements.

Since the inflow of trade receipts in 2007 and early 2008 weren't viewed as sustainable, they obviously felt that upward pressure on the Ringgit had to be capped to avoid a sharp depreciation afterward. And when inflows did turn into outflows, BNM also acted to limit the downward movement. These operations are consistent with a managed float regime, where volatility reduction is a goal.

Hence the sharp changes in reserves, as well as the changes in BNM bills left outstanding in the market - intervention was also sterilised to maintain BNM's real target, which is the short-term domestic interest rate:

5. One last point on the statutory reserve requirement:

The money multiplier (see this post on what this means) based on banks' reserve deposit assets:

...and reserve deposits as a percentage of loans:

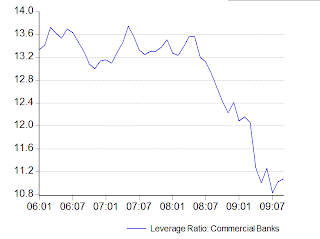

As I said in the last post, banks aren't basing credit expansion on the reserve ratio, but rather on the capital ratio:

A statutory reserve requirement of 1% implies a potential money multiplier of 100x, while 0.5% implies 200x. The actual average is actually only around 4x, in contrast to the leverage ratio which was almost right to the limit of what's allowable.

Subscribe to:

Post Comments (Atom)

This comment has been removed by the author.

ReplyDelete