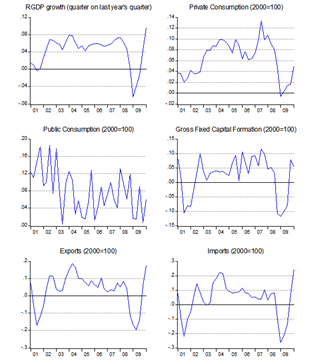

Yesterday’s GDP numbers included some revisions to previous data that changes the growth numbers somewhat, but doesn’t change the fact that the economy posted some pretty good numbers for 1Q 2010, beating the consensus estimate by 0.7% to reach 10.1% for real GDP growth (log annual changes; 2000=100):

While growth was across the board, the real driver was a strong upswing in trade over last year’s numbers. The rest of the components posted less than impressive growth numbers.

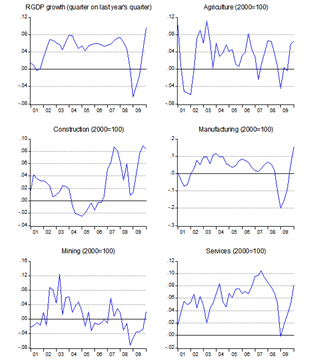

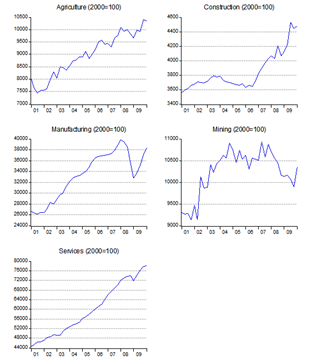

The supply side showed equally solid growth across sectors except for mining, with manufacturing leading the way (log annual changes; 2000=100):

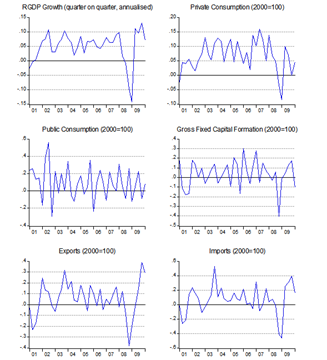

I think these solid numbers prompted BNM to continue with their “normalisation” of interest rates, though it’s interesting that the market is talking about “better than expected” whereas BNM is saying “recovery is well entrenched”. That’s a nuanced view of things, and if you look at quarter on quarter growth, you’ll see why – although we still see growth, the magnitudes are less than comforting.

On the demand side, trade is still driving GDP up, but growth is well down from 4Q 2009 (log quarterly changes, seasonally adjusted and annualised; 2000=100):

Note that investment is nearly 10% down from the last quarter, and trade volume is falling. Private consumption is still weak (+4.4%), although there is some minor support from government spending (+8.4%).

On the supply side, it’s agriculture that’s showing negative growth (-3.0%) while mining in contrast has zoomed up (19.8%). Manufacturing growth has slowed though still high at 14.9%, but the construction (+3.2%) and services (+1.3%) sectors are almost flat (log quarterly changes, seasonally adjusted and annualised; 2000=100):

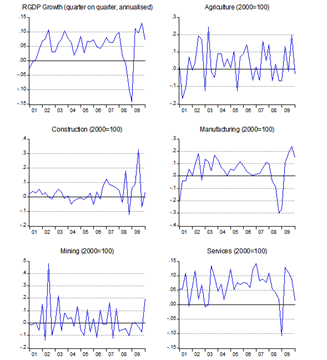

Under these circumstances, I’ve always found it useful to look at the levels, rather than growth numbers. There’s always a risk of a distorted picture using growth metrics alone when an economy is going into or coming out of a recession. The contrasting scenarios shown by the different growth measurement methodologies certainly suggest looking beyond mere growth numbers (real GDP; 2000=100):

On the demand side, it’s clear that trade caused the recession, and trade has largely brought the economy back. The levels are still below 2008 peaks however, and investment is lagging the other components. Private consumption is a little weaker than it should be, though it looks like its more or less back to its long term growth path.

On the supply side, manufacturing took the brunt of the recession (mining looks bad, but the numbers are approximately level). I’d discount the contribution of the construction sector because it’s so small, while agriculture and services are substantially unmoved off their long term growth paths.

For the rest of the year, the prognosis for growth depends really on whether there is a full recovery in trade and investment. I think that’s likely as the US economy is strengthening and Europe and Japan have bottomed out. The risk factor is primarily in my view a pullback in growth in China, which I think is unlikely over the near term – of course, I’m no China expert so take that with a bucket of salt.

But to return to the issue of “normalisation” of the OPR, from the look of things, there’s still a substantial positive output gap i.e. the difference between actual and potential output of the economy. That in turn suggests that there’s not much foundation for a structural rise in inflation, which in turn argues for a more moderate approach to increasing interest rates.

I’m not keen on the “asset price bubble” story, as I see little evidence that cheap domestic money is playing a role in driving up asset prices locally. It’s hot money from outside the country that is propping up the bond market and causing the Ringgit to rise, and an interest rate hike (while penalising existing bond holders), will attract further foreign portfolio interest.

Time for capital controls? Maybe, especially as the thinking on capital controls have turned 180 degrees in the last ten years.

Technical Notes:

1st quarter 2010 GDP report from the Department of Statistics

No comments:

Post a Comment