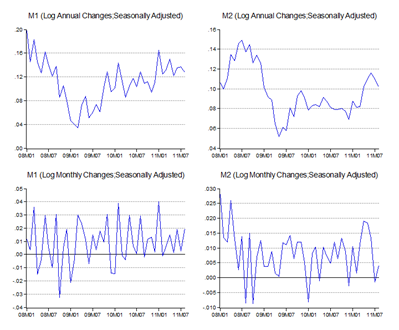

This is kinda an omnibus edition because I missed this post update the last two months. Not that the news gets any better with time…vinegar instead of wine so to speak (log annual and monthly changes; seasonally adjusted):

Growth of both M1 and M2 aggregates have been below the norm the last few months. If it weren’t for the spike in new cash issued for Ramadhan, the numbers might look even worse.

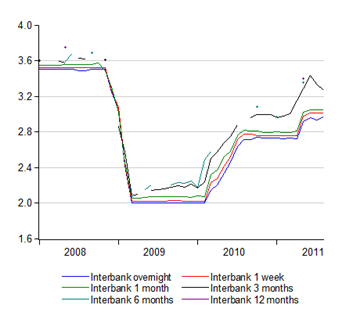

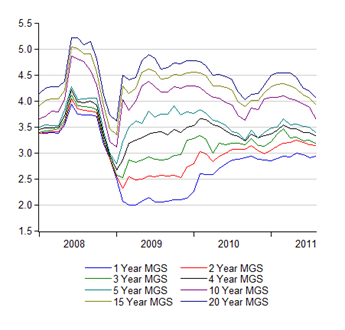

Worse, the yield curve is flattening across the board:

The deterioration in global conditions over the last three months has been marked, and that’s obviously affected the domestic markets. The yield curve for BNM bills actually inverted in August – the last time the negative spread was this big, we were right at the bottom of the recession in April 2009. BNM’s apparently been intervening in the forex market through September to supply USD to the banking system, as flight to safety has taken hold over the next month or so.

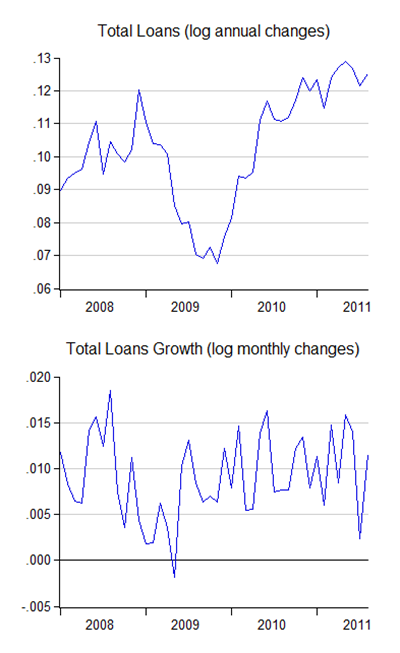

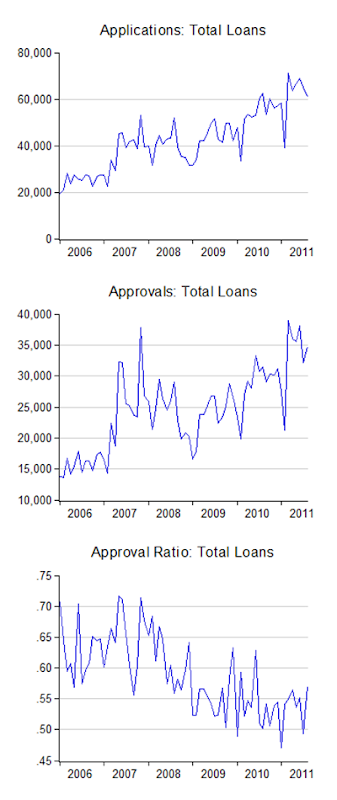

Yet even as monetary conditions softened, you wouldn’t know it from looking at loans (log annual and monthly changes):

Credit standards appear to be loosening… a little. Applications for working capital loans recorded its first positive monthly growth in August since March, which is a good sign. I might be grasping at straws here though.

Bottom line: The market looks like its actually leaning towards pricing in a rate cut at the next Monetary Policy Committee meeting next month. Unless there’s a real fundamental breakthrough in the Euro crisis, or the Fed does a lot more to reinflate the US economy, I’m not about to bet against the possibility.

Technical Notes:

Data from the August 2011 Monthly Statistical Bulletin from Bank Negara Malaysia

No comments:

Post a Comment