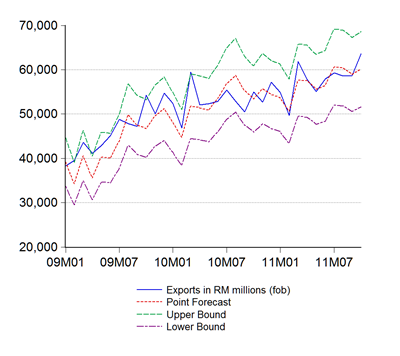

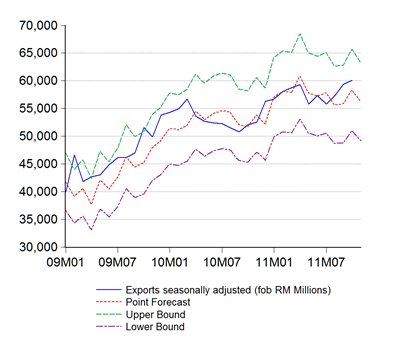

Friday’s trade numbers underscore the resilience of the economy as shown by industrial production. Not quite out of the forecast band, but about 1 standard deviation away from the predicted value (RM millions):

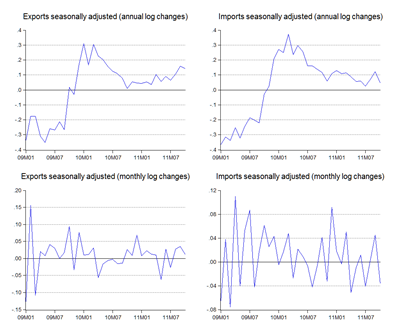

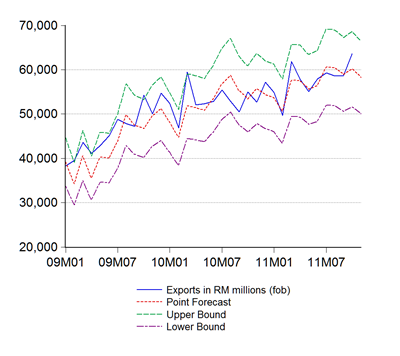

Exports hit RM63.6 billion, the highest ever recorded in a single month (log annual and monthly changes; seasonally adjusted):

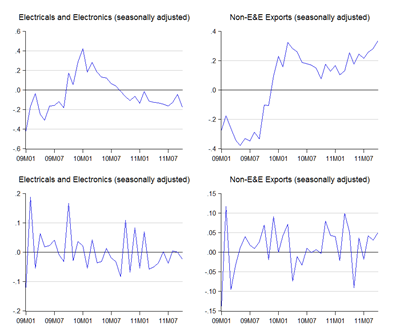

Again, as in industrial production, actual realisation beat the consensus forecast. Reading between the lines, it seems as if there’s an overweighting of electronics and electrical exports, even as the evidence increasingly shows that the E&E sector has long since ceased to drive export growth (log annual and monthly changes; seasonally adjusted):

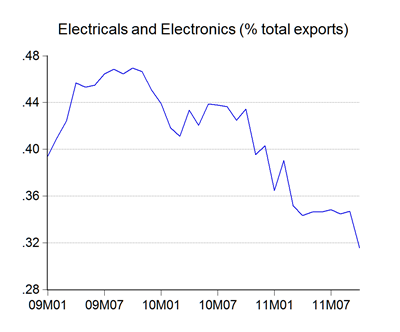

In annual log terms, E&E export growth has been in negative territory since August 2010; in monthly log terms 7 out of the last 10 months. If you need more evidence:

Obviously the trouble in Europe is having an impact, but Malaysia’s exports are pretty diversified.

Of course, this can’t last – for as long as I’ve been forecasting exports on this blog, spikes in export numbers this far off the point forecast have typically been followed by a reversion to the point forecast the following month.

The November forecasts suggest a pullback of RM4-5 billion, though the annual growth numbers will look even better than October’s:

Seasonally adjusted model

Point forecast:RM56,266m (6.5% yoy, -12.2% mom)

Range forecast:RM63,319m-49,212m

Seasonal difference model

Point forecast:RM58,239m (10.0% yoy, -8.8% mom)

Range forecast:RM66,481m-49,997m

Technical Notes:

October 2011 External Trade Report from MATRADE.

No comments:

Post a Comment