Yesterday’s trade report from Matrade indicates that export growth jumped in May, but not as much as my models say they should have (log annual and monthly changes; seasonally adjusted):

Exports hit 7.0% on the year in log terms (6.7% in percentage terms) and 2.0% higher than last month’s level. Crude oil exports fell, but this was offset by higher LNG and CPO exports.

Meanwhile, electronics and electrical products continued to underperform, though exports were somewhat better than last month (log annual and monthly changes; seasonally adjusted):

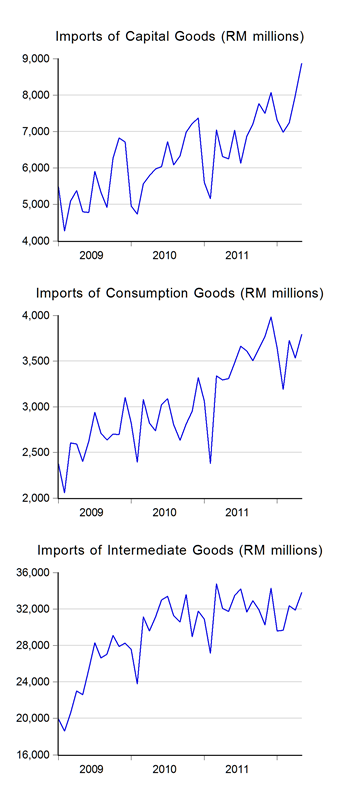

The big story is of course zooming imports, particularly capital goods imports (RM millions):

With lots of investment projects slated for this year, it’s not that big of a surprise, but this does indicate “leakage” in the sense that some part of domestic investment requires foreign goods (a minus in the national accounts) and probably labour as well.

Nevertheless, this substantiates the narrative that growth this year will be based on domestic demand rather than external conditions. Certainly, poor growth in imported intermediate goods suggests export weakness will be a continuing feature over the near future.

For next month, we should see slightly brighter numbers:

Seasonally Adjusted Model

Point forecast:RM65,844m (12.9% yoy, 11.3% mom) Range forecast:RM74,422m-57,265m

Seasonal Difference Model

Point forecast:RM65,800m (12.9% yoy, 11.3% mom) Range forecast:RM75,382m-56,219m

Technical Notes:May 2012 External Trade Report from Matrade

No comments:

Post a Comment